Budgeting tips | 7 practical steps to create a personal budget

Are you seeking the best budgeting tips and practical steps to create a personal budget?

When was the last time you cringed when someone mentioned “budgeting?” I tell you, the topic is a dicey one, especially when you don’t earn enough and are left wondering why budgeting is vital in the first place.

I remember advising a friend to plan his expenses, and his response was, “I don’t even have enough to eat, so how can I plan with so little?” While that is true, the mystery of budgeting is that the more consistent you get with practicing budgeting tips, the more expendable cash you free up from the “little.”

With budgeting, you learn how to prioritize your financial freedom, live in your abundance, and experience financial peace.

But first, what is budgeting?

What is Budgeting?

Budgeting is simply accounting for every income you earn, including savings, debt repayment, investment, expenses, fun money (you like the sound of that? haha), etc. It allows you to track your spending habit while demonstrating a high level of responsibility many people struggle with. There are different types of budgeting which I will talk about shortly,

Photo by Dylan Gillis on Unsplash

Why you should create a budget

You are reading this because you want to take control of your finances, which is GREAT, but before sharing reasons why you should create a budget, remember this: it’s one thing to create a budget, and it’s another to follow through with your budgeting plans. With that understanding, I always advise having a financial buddy or an accountability partner to keep you grounded. Budgeting apps are great, but a human reminder works magic!

Here are some reasons you should create a budget

- Reduce financial stress: With a budget, you feel more organized and in control of your finances. You know what needs to be paid, saved, invested, and what’s left for miscellaneous. In short, you are in control of your finances. Now, who doesn’t want that?

- You are better prepared for emergencies: Imagine you had a budget with an emergency fund plan and stuck to it; when emergencies arise, you are ready to handle them. And that screams freedom!

- You lead a happier financial life: You know how they say “money stops nonsense?” same applies to when you are in control of your finances. There is less stress about what needs to be paid and how it will be paid since you already made plans ahead of time.

- It helps you achieve your financial goals: Now, you can pay down your debts, save for that trip to Bali, invest in your business as you’ve always wanted, etc.

GET MY GUIDE ON HOW TO CREATE A PERSONAL BUDGET: How to Create a Personal Budget: A Beginner’s Guide

RELATED POSTS

- 18 best money-making apps for Android and iOS that work

- 23 easy money-saving tips for students and young adults

- 37 Legit Ways You Can Make Money As A Teenager

- 20 Top Pick Virtual Assistant Jobs For Beginners To Make Money

Budgeting tips for creating a personal budget

There are many budgeting tips to consider, but here are 7 practical steps to create your budget in this order.

- Compile your financial statements

From your loan payment statements to mortgage, credit card and utility bills, tax returns, business income statements, tracked expenses, receipts, investment statements, etc., gather every financial statement about your expenses and revenue to help assess your income and expenses in the next steps.

Photo by Kelly Sikkema on Unsplash

- Calculate your monthly income

With your gathered statements, thoroughly calculate your monthly income. You could get a yearly estimate, but that may be too broad hence the monthly estimate. Your income isn’t limited to your paycheck but every source of stable monthly revenue, including grants, scholarships, side business revenue, etc. If you are self-employed, calculate your net income devoid of business expenses, employee salary, and the likes.

For example, Mr. A is a bank manager who receives his salary of $2,100 bi-weekly, makes $3000 net income from his salon business, and receives $500 monthly from his investment company.

Average income for Mr. A

Monthly salary: $4,200

Business net income: $3000

Investment revenue: $500

TOTAL: $7,700

- List all monthly expenses

Analyze your average monthly expense deeply without leaving any expenses. You can check your bank statements and credit card statement to help you get a good grasp of your monthly payments.

Mr. A’s monthly expenses could look like this:

Transportation: $150

Food & Groceries: $300

Child’s expenses: $200

Utility bills: $450

Mortgage: $1200

Loan repayment: $750

Credit card payment: $50

Miscellaneous: $150

Insurance plan: $100

Car payment: $200

TOTAL: $3,550

- Get your budgeting app ready

My all-time best budgeting app is MINT, and there are other great ones too. With any of these apps, it’s best to have done steps 1-3 to make getting started on the app smoother.

- Create an account on the budgeting app

- Set your financial goal

- Connect your account

- Streamline the features to your needs, but first

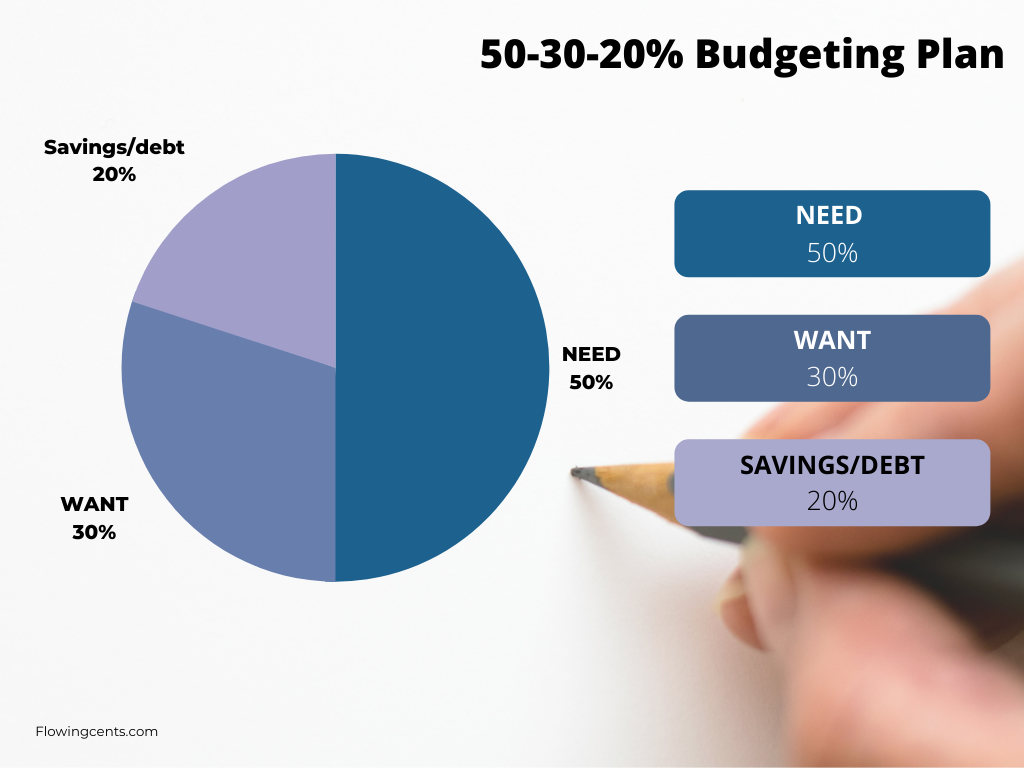

- Decide on your budgeting plan

There are several budgeting plans, including the zero-income budgeting and 50-30-20% budgeting. The zero-income budgeting accounts for every dollar in your income, leaving nothing out. In simple terms, you spread out every income into your budgeting plan, whether as savings, expenses, investment, miscellaneous, etc. While the 50-30-20% rule allocates 50% of your income to need-based expenses, 30% to want-based expenses, and the last 20% to your savings and debts, I prefer the 50-30-20% rule, but you should check out the different types and go for what suits your goals.

- Set achievable budgeting goals

Oh, you are ready to rock and roll!!! Moving on, set achievable short-term and long-term budgeting goals. An excellent short-term is paying down loans and credit card bills, while a great long-term goal is saving to invest in real estate in your 60s. No matter what, set a realistic goal.

- Track your budgeting plan

Using your budgeting app, track your budget to see if you are on track with the budgeting plan you set for yourself. If you are on track, GREAT. If not, check what’s causing the lapses and rectify it.

Budgeting mistakes to avoid when creating a budget

You are one step closer to your financial freedom. While at it, never be caught off-guard with your budgeting plan by avoiding these mistakes.

- Setting unrealistic budgeting goals:

You want to use half of your monthly income to pay down your loan, which is good but unrealistic. Consider other monthly expenses and your reality. If you live alone, this won’t be wise. It might be possible if you live with family, but a little far-fetched. In short, set realistic goals.

- Not accounting for emergencies:

You can’t save ONLY! Neither can you cater only to debts and expenses. Think ahead by setting up an emergency fund which will come in handy when the need arises.

Photo by Kenny Eliason on Unsplash

- Letting your budget control you:

You do yourself a disservice if you allow the fear of achieving your goals to control you to the point of anxiety. Remember, you set a budget to help take charge of your finances and not the other way round. Remind yourself often!

- Not reviewing your budgeting goals often:

Reviewing your goals allows you to spot lapses early on. Aside from that, you know when you are doing great, and you can pat yourself on the back.

- Being irresponsible despite budgeting plans:

You got it wrong if you think a budgeting app is all you need. A plan needs an implementor which is you! If you are irresponsible, a budgeting plan can’t help you be responsible. So learn how to be responsible if you want to enjoy the benefits of effective budgeting.

FINAL THOUGHT

Learning budgeting tips, implementing the tips, and practicing effective budgeting help you lead a stress-free financial life. If this is your first time creating a budget, you might want to go with the 50-30-20 rule where you give 50% for your needs, 30% for your wants and 20% for savings and investments.

When your needs cross the 50% threshold, i.e., your basic needs take more than 50% of your income, you can adjust the percentage of your wants to 20% instead.

Also, learn to stay consistent with your plans and give yourself grace when your plans don’t work out.

It’s all worth it in the long run, I promise!

Have you tried budgeting before? How easy or difficult was it?

READ ALSO: 10 Easy ways you can make money online as a beginner