The best budgeting apps you should use in 2024 [with reviews]

How often have you created a budget but ended up not sticking to it? I know, right?

Countless!

It is relatively easy to make a budget but challenging to stick to, so one of the best money management decisions you can make will be to use a budgeting app.

There are excellent and free budgeting apps that you can use to manage your money easily and automatically. Most budgeting app features allow users to sync one or all of their credit/debit accounts and manage their finances from a single interface.

It is usually more difficult when it comes to money decisions because you have to forgo some things you love for things you need. Having an app that objectively showcases your income, expenses, and goals can make a difference in your money habits and financial health.

Budgeting definition

Budgeting is purely and simply the process of creating a budget. A budget is a financial plan that you put in place to help you manage your money, and it lists what you should spend on and how much you should spend.

Budgeting apps with reviews

- You Need A Budget (YNAB)

This is number 1 on my list for a reason. Although the rest of the budgeting apps are in no particular order, YNAB is the leading budgeting app you can get for your money, and it helps you achieve your financial goals.

YNAB uses zero-based budgeting that allows users to create a budget based on their income. This budget covers every area of their financial life and makes sure that no amount is unaccounted for. This unique budgeting style is one of the significant reasons why YNAB is popular among users, even though it has a user interface that is a bit complicated compared to other apps.

The YNAB website has tons of educational content that users can use to understand the app better and navigate it. The app is also optimized for several devices, including androids, iPads, Apple watch, and Alexa.

College students have one year of free access to YNAB.

Pricing: Free trial for 34 days

$14,99 per month

$48.99 per year

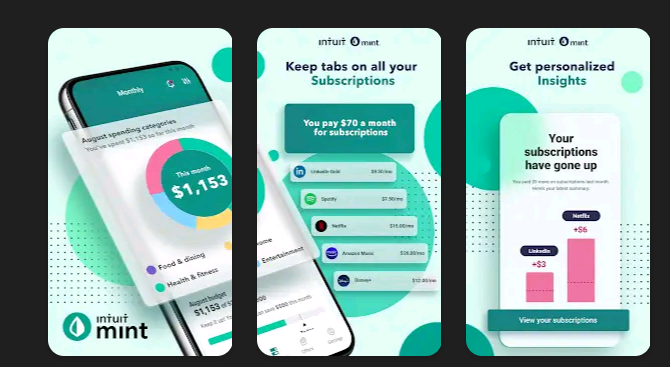

- Intuit Mint.

Mint is best for someone interested in monitoring their daily money activities and tracking their spending. Named as one of the oldest and most well-known budgeting apps, it focuses more on budgeting and has an interface that makes it easier for users to budget, categorize expenses, and track savings.

With Mint, you can also sync several accounts to other financial institutions apart from banks, including lenders, brokerage, credit card issuers, etc. Mint then looks into your overall financial accounts and lets you know where your money goes every month.

For users using the app, there is a detailed FAQ section and a list of known issues with the app. The overview of the user’s financial accounts also includes their credit score and net worth.

Devices: Available for Android and iOS devices

Pricing: Free

- Personal Capital.

Personal Capital by Empower gives you insight into your entire financial situation and is best for portfolio management. With an easy-to-use interface, users get to input their bank details, debt details, expenses, and income. At the same time, the app automatically takes an overview and shows it to the user while also generating a way to plan for the future effectively.

It gives you a financial overview of your bank account, and it also tracks your spending from day-to-day activities to financial goals. So, it focuses on your short-term and long-term finances. It has a retirement planning system and an education planning system for college.

You can create an investment planning system for yourself with a certain percentage of your income and get a 0.89% for a $1million investment.

The company partners with a financial technology company to give financial security to all its users.

There are no automated systems or particular tracking features for budgeting. Still, the app lets you add your budgets manually, categorize them, and compare them with previous months, so the weight of tracking your budgets and spending habits rests solely on you.

It requires a minimum of $100,000 in an account.

Devices: Available on Android and iOS devices

Pricing: Free

- Goodbudget.

If you’ve ever wondered about how to budget using the envelope system, this is the best bet for you. The envelope system is an old-fashioned way of budgeting where you literally have your funds shared inside different envelopes. Each envelope is for a particular household purpose like feeding, accommodation, transport, repairs, savings, etc.

Goodbudget has a free version where users have access to just 20 digital envelopes to manage their finances compared to the paid version, where the number of envelopes is unlimited. The free version is fair to users as it contains most of the paid version features aside from the extended capabilities.

A nice feature of this app is the educational content like webinars, podcasts, and blog posts that are constantly updated to give each user access to financial literacy.

However, Goodbudget is not automated, which is a significant setback, especially for people who want to sync their budgeting apps to debit cards. The free version allows only one bank linkage, and if you have several accounts, you can only keep track of one.

Devices: Available on Play Store and Apple Store.

Pricing: Free version

$8 per month

$70 per year

- PocketGuard.

As the name implies, PocketGuard literally guards your pocket by monitoring your spending and helping users curb overspending. Its primary focus is to prevent you from overspending, and it does this by calculating your income, expenses, and budget and with its algorithm tells you the amount of money you should spend in a day.

With all the essential features of a basic budgeting app, PocketGuard lets you sync to a bank and offers a paid version while automating budgeting. It lets you know when your bills are due, reminds you of recent spending, and has an automated saving system.

There are different versions of the PocketGuard plan, including the fRee, Paid, Premium, and PocketGuardPlus.

The security of your finances is also ensured with its 256-bit encryption, biometrics, and a 4-digit pin.

Devices: Android and iOS devices.

Pricing: Free

$7.99 per month

$34.99 per year

$79.99 lifetime subscription

- Zeta.

With bank-level security and encryption, Zeta caters to the needs of couples. The app is famously known for catering to the needs of all types of couples, including married, engaged, or new parents. You can sync accounts, track spending together and even share control.

From creating budgets, tracking spending, creating joint goals, and managing bills, my favorite feature of the Zeta app is the bill reminder, which lets you keep track of payments and prevents forgetting about loan repayment. The bill reminder also keeps you focused on your goals and helps you reach them more easily.

You can also create a joint account that comes with a card, no account fees, access to ATM networks, contactless payments, unlimited transfers, and even bill payments. Logins are not saved on the app, and a verification system protects the app.

Devices: Android and iOS devices.

Pricing: Free

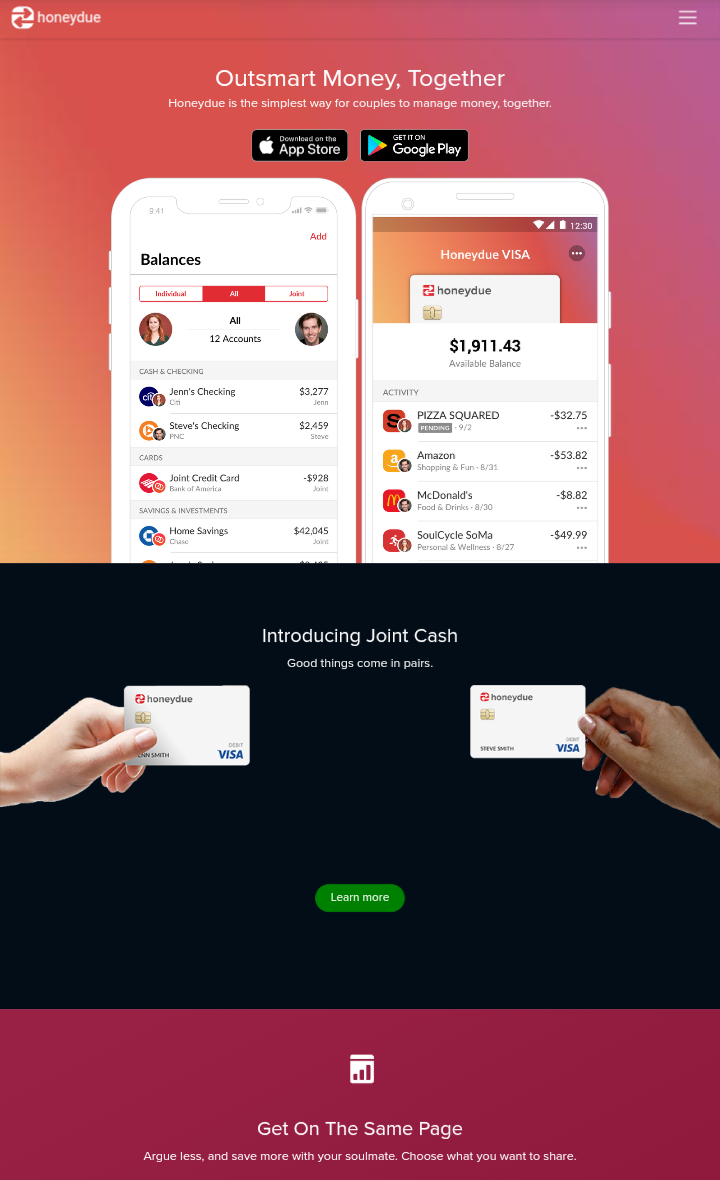

- Honeydue.

Sweet like honey, Honeydue is one of the best budgeting apps for couples. It allows couples to view both of their financial statements in one app. The user has control over how much information they share with their spouse, although you can choose to synchronize your accounts, loans, credit cards, and investments.

Honeydue has an automated system that categorizes your expenses and lets you customize these categories manually. You can set a limit for each category, and Honeydue automatically alerts you when you are nearing the limit. Anyone you add to these categories can also get the notifications.

It also has in-app messaging platforms where you can chat with your partner by sending texts and emojis within the app.

The con of Honeydue is that it focuses more on tracking spending than having a futuristic financial plan.

Devices: Available on Android and iOS.

Pricing: Free

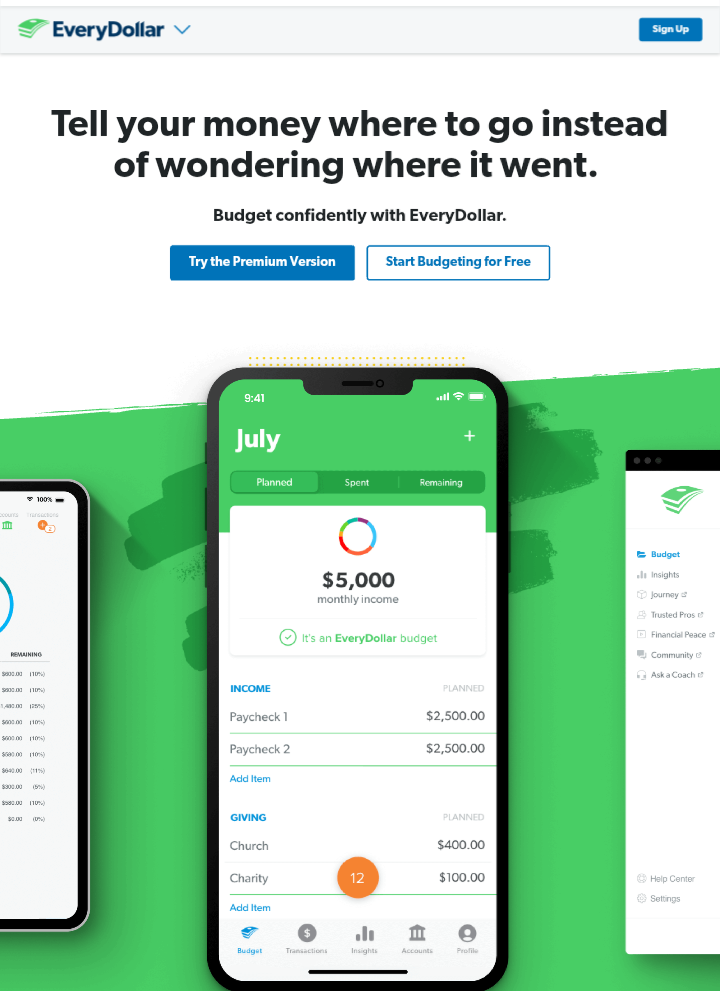

- EveryDollar.

Using a system similar to YNAB, Everydollar utilizes a more uncomplicated zero-based budgeting strategy. It has a free and paid version, although the difference is vast.

The free version is very limited in functionalities. It only allows you to input incoming and outgoing data manually and does not sync accounts, making income tracking almost impossible. However, you can categorize items in your manual budget and set bill payment reminders.

When you upgrade to the paid version, you literally get all the features of the Ramsey+ membership, which includes Ramsey Financial Peace University, EveryDollar, Baby Steps program, SmartTax, Group Coaching, audiobooks, and courses.

The free version might not be able to give you a budgeting strategy that will work unless you upgrade. You might want to go for other free budgeting apps if you’re thinking of the cost.

Devices: Available for both Android and iOS users

Pricing: Free version available

Free trial for 14 days

$59.99 for 3 months

$99.99 for 6 months

$129.99 for 12 months

RELATED POSTS:

- 10 Easy ways you can make money online as a beginner

- 18 best money-making apps for Android and iOS that work.

- Money management tips for couples | 12 best ways to manage money

Tips for having an effective budgeting

If you want to have effective budgeting, here are some tips to keep at heart:

- Always automate your savings

- Have a saving goal

- Have a spending limit

- Use money management apps

- Avoid debts and pay off existing ones

- Avoid impulse buying or splurging

- Restrict your access to your savings

- Track your expenses

- Set a timeframe for your goals

FINAL THOUGHTS

When it comes to having solid and automated budgeting that you can track and get updates on, YNAB is still the best, but if you are using price as a factor, you might want to consider the Intuit Mint app for your budgeting.

Budgeting apps are good, and when you see one that aligns with all your plans, it gets even better. But, an automated system is liable to errors, so it is best that you backup your apps with an old-fashioned budgeting system. You might not need to put in all your financial data but only the ones that are important in cases of emergencies.

FAQs about budgeting

How do I create a personal budget?

Creating a budget is easy but sticking to it is what isn’t. Here’s how you can create a workable personal budget:

- Determine your income after tax

- Differentiate your wants and needs

- Select a budgeting plan

- Track your progress

- Automate savings

- Stay consistent

- Review your budget

Are budgeting apps effective for budgeting?

Yes, several budgeting apps can help you keep track of your income monthly. Some are entirely free, while others allow you to access more functionalities when you upgrade to a paid plan.

If you want to track spending, you should consider YNAB or EveryDollar. If you’re interested in getting an overview of your finances, Mint and Personal Capital will sort you out.

The other apps are a combination of both.

What should I consider when choosing a budgeting app?

Your selection factors should be based on why you need a budgeting app.

It could be to track your spending, create a budget for your income or save more effectively.

Irrespective of the purpose, here are some key features you should consider when selecting a budgeting app:

- Simple user interface

- Syncing accounts

- Financial security

- Reviews & customer feedback

- Pricing options

- Device compatibility

How often should I review my budgets?

This is based on personal preference. You can review your budget weekly, monthly, quarterly, every six months, or yearly.

Monthly reviews are the best because you can keep track of your monthly income and know how to prepare for the next.

RELATED: Budgeting tips | 7 practical steps to create a personal budget